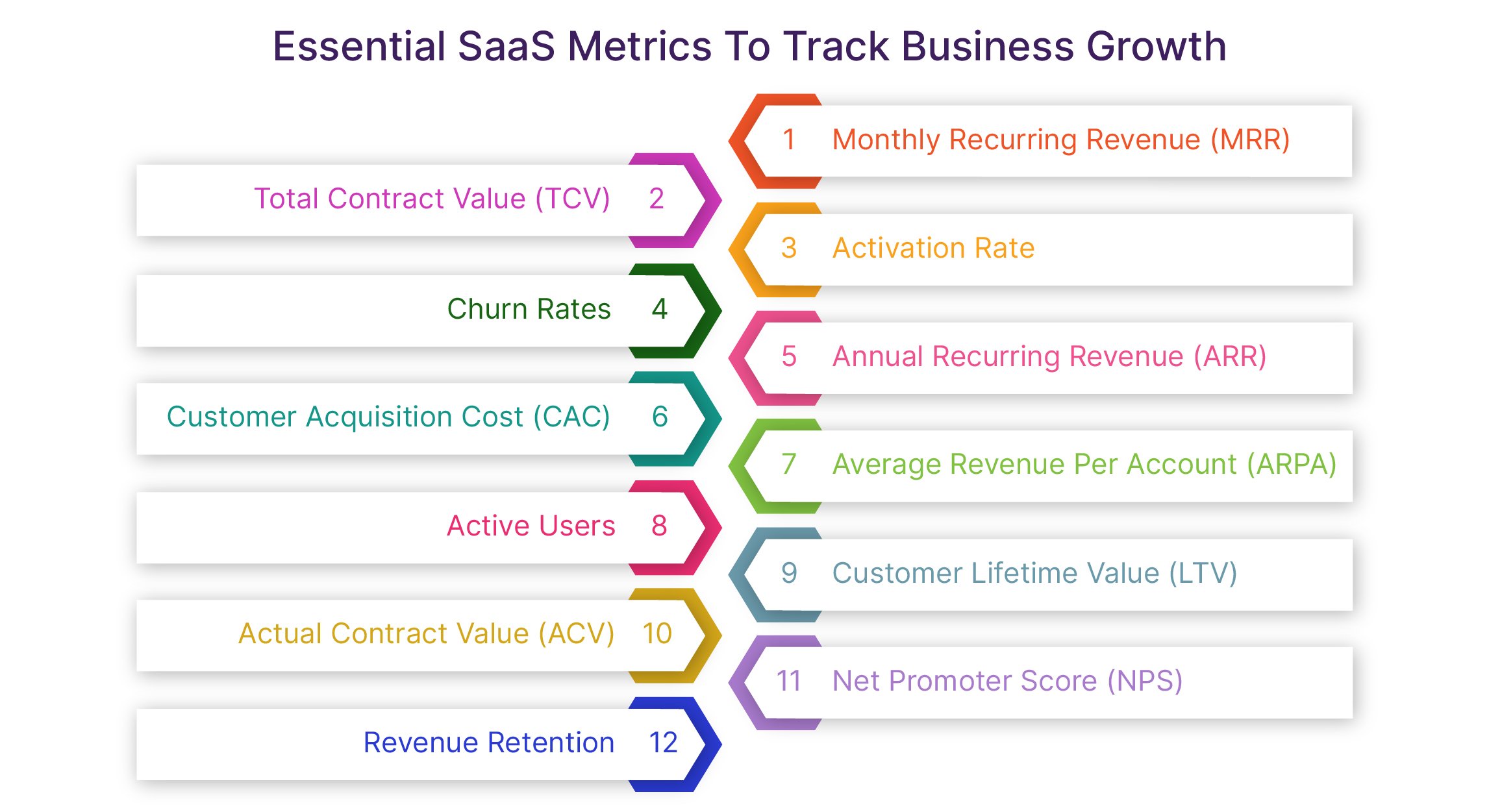

12 Best SaaS Metrics Every SaaS Product Owner Must Know!

Last Updated on September 5, 2024

Quick Summary:

In the rapidly evolving Software-as-a-Service (SaaS) landscape, staying at the top of the competition requires more than great products or services. It is essential for businesses to comprehensively understand the growth potential, customer value, sales performance, and other essential factors. This is where SaaS metrics come into play. Utilizing SaaS metrics, SaaS product owners or businesses can obtain crucial insights and performance analysis that help make informed decisions. In this blog post, we are going to discuss 15 top SaaS metrics every SaaS product owner must know, including ARR (Annual Recurring Revenue), Activation Rate, Monthly Recurring Revenue (MRR), ACV (Average Contract Value), and more. Let’s dive in.

As you know, most Software-as-a-Service businesses offer products or services to customers by charging a monthly or yearly subscription fee. That means these SaaS businesses depend significantly on sustaining their business growth in the long term. Unlike traditional business models, a SaaS business model does not aim solely at targeting customers making one-time purchases.

Instead, SaaS business owners focus on constantly attracting new customers and retaining existing ones to secure long-term business growth. Fortunately, tracking and analyzing key SaaS metrics allows you to measure every aspect of your business growth, improve your sales strategies, and enhance marketing tactics.

Apart from SaaS architecture, SaaS business owners use SaaS metrics to track and monitor their business growth and performance. This allows you to monitor current business statistics and improve strategies and planning for future growth. Understanding and evaluating different SaaS metrics depending on the business objectives will benefit owners or founders of SaaS companies.

Some organizations also opt for SaaS analytics software integrations to measure crucial business and financial aspects. By understanding the essential SaaS KPIs, enterprises can also differentiate themselves from rivals, including companies offering on-premise software to customers.

Software-as-a-Service metrics are critical for SaaS-based businesses of all sizes, from large-scale companies like Slack and Shopify to micro-SaaS businesses like a finance tracker application. Leveraging different SaaS valuation metrics will help in tracking the right business parameters and factors, offering insights and data related to overall performance.

You can make wise decisions by evaluating the essential SaaS metrics, which helps you take a step toward achieving the desired results and objectives. SaaS product owners can determine the revenue generated in a defined time period and analyze the existing, new, and recurring customers, which helps improve their future planning and strategies. Now, let us review some of the crucial SaaS metrics you should consider evaluating to achieve business growth.

As the name suggests, Monthly Recurring Revenue (MRR) is a crucial SaaS metric that helps companies identify the revenue generated over a month. The revenue can come from new sales or existing customers in a Software-as-a-Service business. You should know, that multiplying MRR by 12 can provide Annual Recurring Revenue (ARR).

By calculating the MRR of your SaaS product, you can appropriately set the pricing strategy and ensure that you offer customers quality services, allowing consistent growth. MRR helps you avoid undervaluing your services and gauge how your business grows.

? Monthly Recurring Revenue (MRR) = Total revenue received per month

Total Contract Value (TCV) measures the actual or total revenue received from contracts. Among the crucial SaaS KPIs, TCV allows businesses to make accurate revenue estimates, identify precious customers, and enhance sales strategies.

When calculating Total Contract Value (TCV), you should note that it includes the amount of one-time subscriptions, professional service fees, add-ons, and contract renewal charges. SaaS product owners can measure the value a customer contributes to their business through contracts by calculating the TCV metric.

? Total Contract Value (TCV) = Monthly Recurring Revenue (MRR) X Contract Term Length (in months) + Contract Fees (including professional services, one-time charge, etc.)

Many businesses consider the Activation Rate metric as a direct way to measure the success of a product. Activation Rate helps disclose a customer’s steps to realize the product or service’s value or critical event.

For example, a ride-sharing application is only activated when a user books and makes payment for their first ride. Once the user triggers the primary event of any SaaS application, only then will they experience the product value. With the help of the Activation Rate, you can discover how different users interact or which in-product actions they take. Hence, businesses can shorten the time users take to unveil the value of a product.

? Activation Rate = Number of users to successfully trigger the critical event / Total number of users

Churn Rates, one of the most popular SaaS marketing metrics, can not be avoided when measuring loss and growth. Whether you want to measure the loss of customer recurrence, contracts, GAAP revenue, or Monthly Recurrence Revenue (MRR), calculating Churn Rates can be helpful. You should know that Churn Rates can be calculated in ratio or rate, but sometimes they can be expressed as numeric numbers.

SaaS businesses can have different churn metrics based on their unique goals and desired results. But that doesn’t mean exploring some familiar churn SaaS metrics isn’t beneficial. Below are some common churn types you should be aware of:

Customer Churn

In simple terms, customer churn is the rate of customer loss. It is also referred to as customer attrition or customer defection. By consistently monitoring the Customer Churn rate, you can quickly notice if any modification in the business strategy is necessary.

Suppose the percentage ratio of Customer Churn is going down. In that case, you will know it’s time to focus your efforts and resources on attracting new customers and retention, or you will have to re-evaluate the marketing plan. SaaS companies report a Customer Churn rate of 5-7%. The Customer Churn rate will be 7% if your business loses seven of 100 new customers.

Revenue Churn

Similar to Customer Churn, Revenue Churn can be used to measure the loss of revenue for a specific period. Just take out the difference between the revenue generated by the new customers over the current and previous quarters. Suppose your business earned $5000 in the first quarter and $4000 in the next quarter. So, here’s the calculation to find the Revenue Churn rate:

? $5000 – $4000/5000 = 2% Revenue Churn Rate

Recurring Revenue Churn

When you need to check the lost percentage of Monthly Recurring Revenue (MRR), you can utilize Recurring Revenue Churn. It will be possible for you to calculate the lost MRR for canceled as well as downgraded customers. For example, if a SaaS business has a $50000 recurring revenue and loses $5000 in revenue from churned customers, then the Recurring Revenue Churn rate will be 10 percent.

Annual Recurring Revenue is one of the best SaaS marketing KPIs that help SaaS product owners to predict the revenue their product or business can generate from its customers per year. ARR allows SaaS enterprises to measure and forecast business and financial growth year-over-year, making it the finest among SaaS KPIs. It will be feasible for you to determine financial performance and make informed decisions about budgeting, resource allocation, and growth strategies.

With the help of ARR, businesses can identify opportunities to optimize revenue generation. For example, if your current MRR is $3000, then the Annual Recurring Revenue (ARR) will be 12 times the MRR value, i.e., $36000. Here’s the formula for ARR:

? Annual Recurring Revenue (ARR) = Monthly Recurring Revenue (MRR) x 12

The primary goal of any online business is turning a visitor into a paying customer. But it will require appropriate efforts, strategy, and a fortune to achieve this goal. The amount of money you invest in converting a prospect into a customer by leading them through the sales funnel is referred to as Customer Acquisition Cost.

CAC is one of the highest costs in SaaS businesses, and tracking it may help you know whether the investment in acquiring the new customers is worth spending upon. SaaS business owners can use Customer Acquisition Cost (CAC) with Customer Lifetime Value (CLV) metrics to ensure their business model is practical.

Worried about declining revenue of your SaaS product?

Let our SaaS development team help you upgrade and optimize your products and services to meet changing consumer demands.

Every customer is vital in SaaS business, as they pay defined subscription fees to access your business’s services or products. But when you need to figure out the revenue generated from each customer or account, Average Revenue Per Account (ARPA) is one of the perfect KPIs for SaaS companies.

You can calculate ARPA monthly, quarterly, and yearly according to their requirements. Calculating ARPA is simple: divide MRR at the end of each month by the total number of customers (new and old) in that month.

? Average Revenue Per Account (ARPA) = Monthly Recurring Revenue (MRR) / Total number of active customers

SaaS product owners should calculate Average Revenue Per Account (ARPA) or Average Revenue Per User (ARPU) separately for new and existing customers. It allows you to evaluate ARPA’s growth and understand customers’ behavior, allowing you to serve them with satisfactory services.

Active Users play a vital role in assessing different aspects of your SaaS product or business, such as improving user experience, enhancing intuitive interface, seamless operations, and tracking business growth. However, you need to understand the definition of Active Users first.

Active Users are the users that interact with the core functionality of your SaaS product or service. For an e-commerce app, Active Users complete the transaction after a purchase. If you witness a gradual decrease in the Active Users for your SaaS business, changing the UI, simplifying the accessibility, integrating OpenAI in SaaS, or streamlining marketing techniques may help. Monitoring the Active Users daily or weekly also allows you to ensure that you attract the right customers.

Customer Lifetime Value (CLV), also referred to as Lifetime Value (LTV), is the sum of the value a customer contributes to a SaaS product or business over time. From initiation to the end of the contract, the amount of money a user spends for the service is CLV.

Customer Lifetime Value is among the critical metrics for SaaS companies, as it gives insight into evaluating the value of your customers and their growth over time. CLV can also help investors gauge the value of your company’s products and services. In a subscription-based SaaS model, a customer’s lifetime value keeps increasing with each renewal until they don’t renew the subscription. The calculation of CLV is as follows:

? Customer Lifetime Value (CLV) = Customer Lifetime Rate (CLR = 1 / MRR) x Average Revenue Per Account (ARPA)

It is essential to know how much a customer pays you annually to understand the worth or value of a customer. Actual Contract Value, or ACV, is among the most critical SaaS KPIs and is perfect for measuring the average value of a customer’s subscription in a year. SaaS business startups know ACV and ARR are the most critical, as they hold the potential to drive success.

Apart from helping companies assess their sales and marketing strategies, ACV also assists in prioritizing the efforts and resources for profitable assets. The calculation formula for Actual Contract Value is as follows:

? Actual Contract Value (ACV) = Value of contract / Length of contract (in years)

Well, calculating ACV for multiple customers is a little tricky. However, let us make it easy for you with the below example:

? Suppose, Customers A, B, and C pay subscription fees of $500, $1000, and $1500, respectively, for one year, two years, and three years.

? Then, ACV for the first year will be calculated by considering all three customers, i.e. ($500 + $1000 + $1500) / 3 = $1000.

? For the second year, ACV for two customers will be ($1000 + $1500) / 2 = $1250.

? ACV for the third year will be for one customer only, i.e. ($1500) / 1 = $1500.

As you know, every business is primarily concerned with customer satisfaction and experience. Thanks to Net Promoter Score (NPS), you can understand customer satisfaction and loyalty towards your brand or product. Among other SaaS metrics, this one will help you determine whether customers are happy with your SaaS product. They will not recommend your product or services if they are unhappy and dissatisfied.

Businesses need customers to fill up the survey forms or rate the likelihood of recommending the products or services to their friends and colleagues. Hence, the outcome will showcase the customer satisfaction rate. If the customers are not satisfied, you can ask them for genuine feedback to enhance the customer experience and win them back. The percentage of satisfied customers minus the percentage of dissatisfied customers is the Net Promoter Score.

When reading the word Revenue Retention, it would suggest retaining customer revenue over time. Revenue Retention means the amount of money you retain regardless of the customer you lose to sustain your business. There are two Revenue Retention metrics: Net Revenue Retention (NRR) and Gross Revenue Retention (GRR).

Net Revenue Retention (NRR): NRR refers to the wholesome change in the recurring revenue over a specific time considering a defined group of customers. NRR acts as a health indicator to evaluate whether your product is a good fit for the market.

? Net Revenue Retention (NRR) = Current MRR from a defined customer group / MRR of the same customer group 1 year ago

Gross Revenue Retention (GRR): GRR is always equal to or lower than NRR. It provides insight into how your business is performing in terms of retaining customers. Factors like increased price, up-selling, and organic customer growth will not be considered when calculating GRR.

? Gross Revenue Retention (GRR) = Current MRR from a defined customer group – (upsells, increased price, or organic growth) / MRR of the same customer group 1 year ago

Hopefully, you have understood that tracking the right SaaS metrics is essential to make informed decisions and improve overall business growth. After going through the 15 top SaaS metrics, you can tailor these SaaS KPIs and combine them to analyze different performance aspects. You can also identify where your business is doing well and in which areas it needs improvement. To ensure your business is on the right track to success, Hire SaaS developers who can optimize your services for growth.

Software-as-a-Service Metrics, or SaaS KPIs, are performance benchmarks that SaaS businesses use to measure and track the growth, performance, and health of their products and services. Business or product owners can make data-driven decisions to improve their financial and marketing strategies, profitability, and customer experience by leveraging SaaS marketing metrics. These metrics can be tracked with the help of integrating SaaS analytics tools into your product.

Like any other business, SaaS businesses can measure performance and profitability by assessing various SaaS KPIs and metrics. These metrics include MRR, CAC, NPS, CCR, and ARR for a better understanding of customer behavior and improved decision-making.

The Rule of 40 is a principle that defines SaaS companies must make strategic and informed decisions such that they maintain a revenue growth rate and profit margin above 40%. Following the Rule of 40, you can sustain business growth and profitability while avoiding cash flow and liquidity issues.

Although all the SaaS metrics are essential to understand, some of the most important SaaS metrics you must track are as follows:

Your Success Is Guaranteed !

We accelerate the release of digital product and guaranteed their success

We Use Slack, Jira & GitHub for Accurate Deployment and Effective Communication.